After spending considerable time using both cash and digital payment methods, we’ve contemplated the idea of a cashless society. In this article, we aim to share our personal perspective on the advantages and disadvantages of transitioning to a cashless society and discuss how we can strike a balance between the benefits and drawbacks.

Understanding a Cashless Society

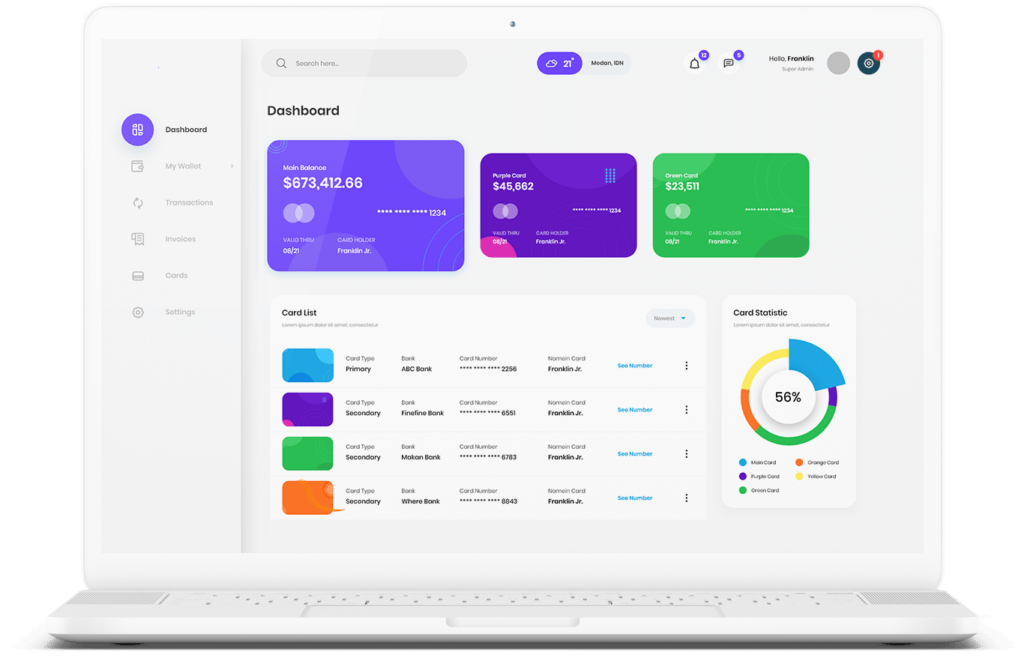

A cashless society refers to an economic system where transactions primarily occur through digital payment methods rather than physical cash. It involves using electronic means such as credit cards, debit cards, mobile payments, and digital wallets.

Pros of a Cashless Society

Convenience

The convenience of not having to carry cash or deal with change is a significant advantage. Transactions can be completed quickly and efficiently, saving time and effort.

Enhanced Security

One notable benefit is the increased security offered by digital transactions. Tracking and monitoring capabilities reduce the risks of theft and fraud compared to cash transactions.

Improved Financial Inclusion

Digital payment methods have the potential to enhance financial inclusion by providing access to banking services for underserved individuals. For example, mobile payment platforms have enabled people in developing countries to access financial services for the first time.

Positive Economic Impact

A cashless society could lead to increased efficiency and reduced costs for businesses. Additionally, it has the potential to decrease tax evasion and the underground economy.

Cons of a Cashless Society

Privacy Concerns

Privacy erosion is a significant concern when transitioning to a cashless society. Digital transactions generate trackable data, raising concerns about surveillance and misuse of personal information.

Digital Divide and Financial Exclusion

While digital payment methods can improve financial inclusion, there is a risk of exacerbating the digital divide. Those without access to technology or the internet may face further financial exclusion.

Overreliance on Technology

Overreliance on technology is a valid concern, as failures or glitches in digital payment systems can lead to disruptions and inconveniences.

Potential for Increased Fees

The possibility of increased fees for digital transactions could disproportionately affect lower-income individuals.

Balancing the Pros and Cons

Addressing Privacy and Security Issues

To strike a balance, privacy, and security concerns must be addressed through strong encryption, privacy policies, and regulations that protect personal information.

Bridging the Digital Divide

Efforts to bridge the digital divide should include affordable access to technology, promoting digital literacy, and developing inclusive financial products and services.

Ensuring Reliability of Payment Systems

The reliability and resilience of digital payment systems can be ensured through investments in robust infrastructure, backup systems, and regular testing and maintenance.

Encouraging Competition and Fair Pricing

Promoting competition among payment service providers and implementing regulations to ensure fair pricing can prevent increased fees from becoming a burden.

Conclusion

In summary, a cashless society offers benefits such as convenience, enhanced security, improved financial inclusion, and positive economic impact. However, privacy concerns, the digital divide, overreliance on technology, and potential fee increases must be considered. Striking a balance involves addressing privacy and security, bridging the digital divide, ensuring payment system reliability, and encouraging fair pricing. Continued innovation and regulation are necessary for maximizing benefits and minimizing drawbacks. By working together, individuals, businesses, governments, and regulators can shape a cashless society that benefits everyone while addressing the associated challenges.

In our journey towards a cashless society, partnering with XBramp, an electronic money institution, can significantly help businesses by offering secure, reliable, and inclusive digital payment solutions. We address privacy and security challenges, bridge the digital divide, and ensure payment system reliability. By leveraging our services, businesses can effectively embrace the advantages of a cashless society while mitigating potential drawbacks, contributing to a more efficient, secure, and inclusive cashless economy.