Table of Contents

Open banking has emerged as a disruptive force in the financial services industry, revolutionizing payments, and financial management. This article explores the role of open banking in the evolution of payments, including its impact on traditional banks, benefits for consumers and businesses, associated challenges and risks, and the emergence of innovative use cases. We will also discuss the future of open banking and payments, along with the opportunities and implications for the financial services industry.

Understanding Open Banking

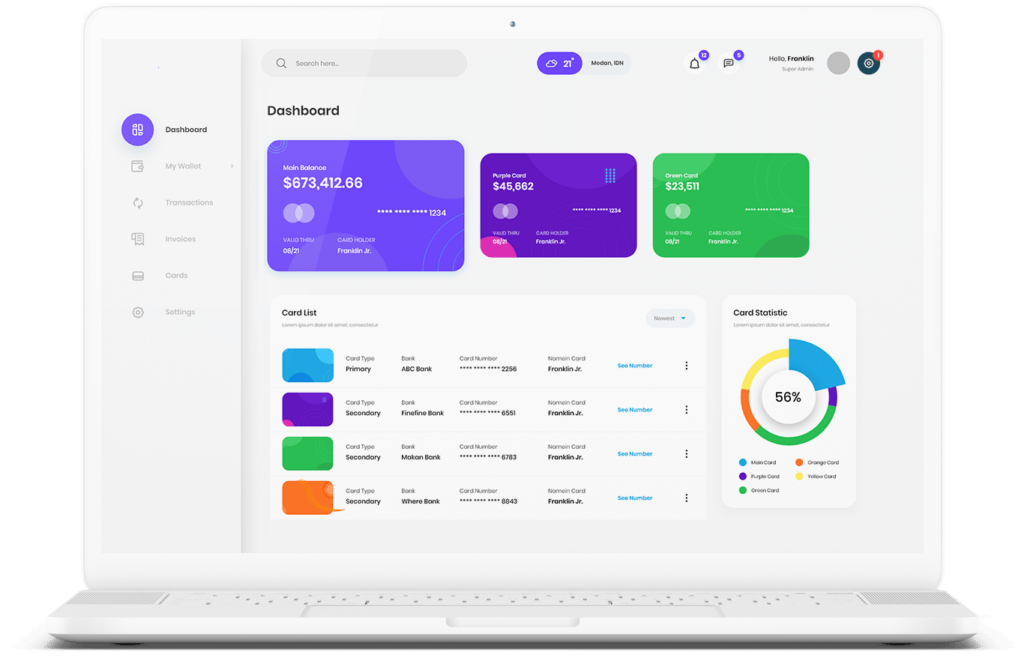

Open banking is a financial services model that allows third-party providers to access bank data and services through APIs (application programming interfaces). This framework enables fintech innovators to create new products and services by leveraging bank data and functionality. The European Union’s PSD2 (Payment Services Directive 2) regulation is closely associated with open banking, as it mandates banks to provide API access to third-party providers. The primary goal of open banking is to foster competition and innovation within the financial services industry. By granting third-party providers access to bank data and services, open banking creates opportunities for fintech, startups, and other innovators to develop products that cater to the needs of consumers and businesses.Brief History of Payments Evolution

Payments have evolved throughout history, starting from bartering and trading in ancient times to the emergence of coins, banknotes, checks, and electronic payment systems like credit cards and wire transfers. The advent of the internet led to the rise of online payment systems, including platforms like XBramp. Today, we are witnessing a new phase of payment evolution driven by technologies such as blockchain, mobile devices, and APIs. Open banking plays a pivotal role in this evolution by enabling new forms of payment and financial management.Transforming the Payments Landscape through Open Banking

Open banking is reshaping the payments landscape in several ways. By allowing third-party providers access to bank data and services, open banking drives innovation in payment initiation, account aggregation, and more. Consumers and businesses benefit from faster, more convenient payments, as well as increased control over their financial data.Open Banking and the Payments Industry

Impact on Traditional Banks and Financial Institutions

Open banking has a significant impact on traditional banks and financial institutions. With the rise of open banking, banks are no longer the exclusive players in the financial services industry. Fintech and other innovators can develop products and services that leverage bank data and functionality, often with greater agility and innovation than traditional banks. To remain competitive, traditional banks must adapt to the open banking model. This involves developing their own APIs, partnering with fintech, or even establishing fintech subsidiaries or acquiring existing fintech companies.Benefits for Consumers

Consumers reap substantial benefits from open banking. It provides access to a broader range of financial products and services, often at lower costs and with greater convenience. For instance, consumers can link their bank accounts to personal finance management apps, enabling better tracking of spending and budgeting. Open banking also offers access to loans and credit products tailored to individual financial needs and circumstances. Open banking empowers consumers by granting them increased control over their financial data. They can choose to share data with third-party providers on their own terms and revoke access at any time. This transparency and control build trust and confidence in the financial services industry.Advantages for Businesses

Open banking also offers advantages for businesses, particularly small and medium-sized enterprises (SMEs). It provides access to a wider range of financial products and services at reduced costs and enhanced convenience. For example, businesses can leverage open banking to access loans and credit products that align better with their specific needs and financial situations. Open banking drives efficiency and automation for businesses. They can automate financial processes like invoice reconciliation and payment processing, reducing manual errors and administrative costs. This allows businesses to allocate more time and resources to core activities.Challenges and Risks of Open Banking

Despite its benefits, open banking presents challenges and risks that need to be addressed.Security and Privacy Concerns

Security and privacy are key concerns in open banking. Third-party providers gain access to sensitive financial data, making it an attractive target for hackers and cybercriminals. Regulators enforce stringent security standards on third-party providers, and banks must provide secure API access to protect customer data. Privacy is another concern as consumers may hesitate to share financial data with third-party providers, even if there are potential benefits. To address this, regulators require third-party providers to obtain explicit consent from consumers and provide transparent information about data usage.Regulatory Hurdles and Compliance Issues

Open banking faces regulatory hurdles and compliance issues. Banks and third-party providers must meet strict technical and operational requirements to comply with regulations like PSD2. These requirements, such as strong customer authentication and transaction monitoring, can be challenging for smaller fintech and startups lacking resources.Competitive Pressures and Market Disruption

Open banking is causing significant disruption in the financial services industry, particularly for traditional banks. Fintech and other innovators can develop products and services more quickly and cost-effectively than traditional banks, driving pressure on banks to adapt or risk losing market share.Open Banking Use Cases and Innovations in Payments

Despite the challenges, open banking has paved the way for numerous use cases and innovations in the payments sector.Payment Initiation and Account Aggregation

Open banking enables payment initiation directly from a customer’s bank account, bypassing the need for separate payment gateways. This streamlines payments and reduces costs for merchants and consumers. Account aggregation allows consumers to connect multiple bank accounts to a single app or platform, providing a comprehensive view of financial data for better financial management and personalized services.Digital Wallets and Mobile Payments

Open banking facilitates innovation in digital wallets and mobile payments. By linking bank accounts to digital wallets and mobile payment apps, consumers can make payments conveniently with a few clicks on their smartphones. This enhances consumer convenience and enables merchants to accept payments easily and securely.Peer-to-Peer (P2P) Payments and Cross-Border Transactions

Open banking enables new models of peer-to-peer (P2P) payments and cross-border transactions. Consumers can directly send and receive payments without intermediaries like banks, facilitating faster and cheaper P2P payments, particularly for smaller amounts. Cross-border payments and remittances become more accessible and cost-effective through open banking, avoiding high fees and long processing times associated with traditional methods.Blockchain and Distributed Ledger Technology (DLT)

Open banking drives innovation in blockchain and distributed ledger technology (DLT). It enables more secure and efficient payment systems, resulting in faster, cheaper, and more transparent payments.Future of Open Banking and Payments

Looking ahead, open banking will continue to foster innovation and disruption in the financial services industry. Expected trends and predictions include: Greater adoption of open banking beyond Europe, where it originated An increased collaboration between banks and fintech to leverage innovation and tap into customer bases and infrastructure Growing focus on data analytics and AI to extract insights from vast financial data Ongoing innovation in blockchain and DLT, applying these technologies to new use cases in the payments domainConclusion

In conclusion, open banking is reshaping the payments landscape by offering new products and services that enhance convenience, efficiency, and security for consumers and businesses. While challenges and risks exist, the benefits and potential for innovation and disruption in the financial services industry are substantial. As open banking adoption expands, we anticipate further exciting developments in the payments space. We encourage readers to explore XBramp Open Banking and consider how they can benefit from these innovations in their financial lives. Whether you are a consumer seeking better financial management tools or a business aiming to streamline payment processes, open banking provides valuable opportunities. Don’t miss out on this exciting frontier in the world of payments!How Can XBramp Help You?

XBramp is a platform that offers open banking services, providing several benefits to businesses:- Faster Payments:

- Better Financial Insights:

- Reduced Costs:

- Enhanced Security:

- Improved Customer Experience: